Capital Gain Tax on Real Estate

Must Read

Capital Gain Property Tax.jpg

The United States has an income based tax system. The federal government receives money for government operation by taxing income in a progressive nature. This not only applies to your wages but also to the sale of your assets. Capital gain tax on real estate is just one ofthe many assets that are taxed upon sale of the asset. The definition of capital gain is the tax paid on profits of non-inventory assets. Capital gain tax on real estate applies to the sale of real property where the profit gained from the sale exceeds a certain number.

Capital gain tax on real estate, like the tax code, has its own exemptions and deductions. One of the primary exemptions in the capital gain tax on real estate is the homestead exception. If the real property you sell is your primary residence and you have lived there for more than one year then you will pay lower capital gain tax on real estate. In 2011 you are permitted to deduct $250,000 from the profits of the sale of your primary residence, $500,000 if you are married and the real property is the primary residence of the marriage.

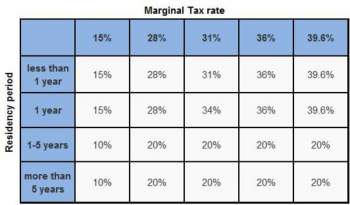

The capital gain tax on real estate for 2011 is a progressive tax, just like the income tax. The tax is based on your marginal tax rate and the period of time that you have lived in the real property. Here is a chart describing the capital gain tax on real estate for 2011: If you need legal advice and assistance, contact real estate lawyers.

NEXT: Estate Tax Exemption