Revocable Trust

Must Read

A Revocable trust is a non-testamentary document that is created, in lieu or in conjunction, with a will. Revocable trusts are those trust that may be re-claimed by the creator, or settlor, of the trust. Once property; or in legal terminology, res, is included in a trust it may still be accessed by the settlor. Unlike irrevocable trusts, revocable trusts may be amended or revoked by the settlor either during his, or her, life or through direction of the settlor’s will.

Revocable trusts can also become irrevocable upon the death of the settlor. Once a settlor dies he, or she, can no longer access the trust assets and, by definition, the revocable trust becomes an irrevocable trust.

There are a set of requirements in the creation of an Revocable trust. First, the trust must have a settlor. This is the individual who creates the trust and puts assets into it. The settlor must have the intent to make an Revocable trust. Courts will scrutinize Revocable trusts to determine whether the settlor’s true intention was to make an irrevocable trust, a revocable trust or a will.

There must also be delivery of the Revocable trust to the trustee. The trustee is the manager of the trust. It is usually an attorney or a financial institution that manages and invests assets. The delivery requirement is very specific; intent is not a valid defense. If you are on your way to deliver your finalized trust to your trustee and you die on route the trust will be invalid.

Every trust, whether revocable or irrevocable must contain property, or res. By law, you are not permitted to create an Revocable trust for the disposition of future assets. The amount of assets that are required in a trust for it to be valid depends entirely on State law.

An revocable trust also requires known beneficiaries. A revocable trust must have specifically named beneficiaries. For example, you can designate the beneficiary of your trust to be Steve Lyons, but you cannot designate “my best friend and his issue” as your trust beneficiary.

There are advantages and disadvantages to a revocable trust, in lieu of an irrevocable trust. A revocable trust is an effective way to manage assets, especially when they are managed by a financial institution. Revocable trusts will also help to avoid guardianship administration in the event of incapacity. Revocable trusts are also an effective way to avoid probate. Probate is expensive and time consuming. By putting your assets into a revocable trust probate is avoided because, upon death, the revocable trust becomes irrevocable and the assets are no longer your estates.

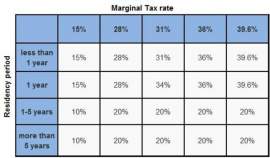

The disadvantage of a revocable trust are that it can still be accessed by your creditors, including the federal government. During your lifetime, and during the time you have access to the trust, the public policy is that you should not be permitted to use a revocable trust as a sword. Creditors are permitted to attack the trust assets, but upon your death, when the revocable trust becomes an irrevocable trust, the trust will be frozen to most creditors.

You do not need to be the settlor of an revocable trust in order to put assets into the revocable trust. Any individual is permitted to give property to a pre-existing trust. The individual is not permitted to designate different beneficiaries. When someone adds to a trust the assets will be distributed, at the time and method specified, to the beneficiaries of the initial trust agreement.

NEXT: Living Trust vs Will